Everything for doctors on one website

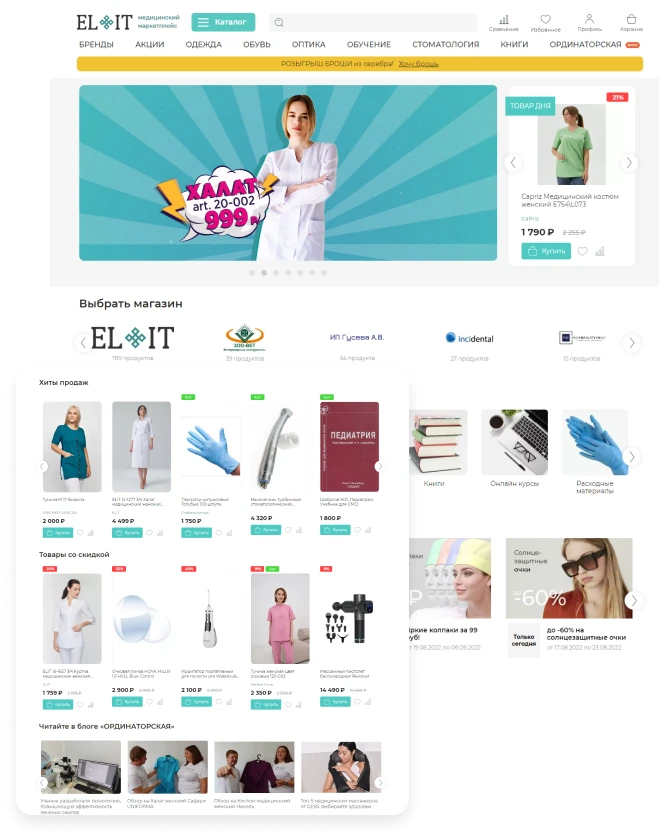

Elit is a medical marketplace with a huge product variety. This is a unique platform for a focused audience with its own expertise. It combines not only special clothing and medical equipment sellers, but also educational institutions.

Field: medical goods Country: Russia Website: Elit

Our client had a production of medical clothing, which he was selling in his online store developed on Bitrix platform. In addition, he had a parallel project – the sale of medical products. Thanks to the accumulated experience in the medical field, the idea was born to combine two projects and create one large marketplace for the sale of medical clothing, literature, equipment, and training courses.

We needed a platform for medical organizations, doctors, where they can not only purchase the necessary products in one place, but also get information, opinions, and exchange their experiences.

Our work process

Platform selection and catalog transfer from 1C

The CS-Cart Ultimate for marketplaces was chosen as the CMS.

Its wide default functionality is enough not only to create a highly loaded project, but also allows to scale the marketplace and expand the geography in the future.

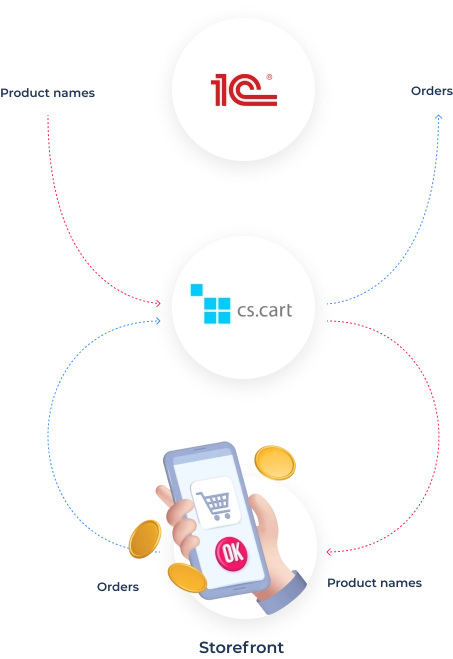

Data transfer from 1C to CS-Cart.

Our client has two working 1C databases: one contains the names of products with their technical names, the second database manages the stock remains and the product names familiar to the buyer.

Data is automatically downloaded from two databases, then data on the name, manufacturer, properties, prices, quantity are linked and uploaded to the marketplace. Then data from orders is being returned to 1C. Thanks to the CommerceML(1C) add-on, CS-Cart allows you to do both manual and automatic uploads and facilitates bookkeeping in 1C.

In order for a vendor to place products on the marketplace, they must be reflected in the warehouse.

In order to do this, a request with product data is sent to 1C, where this information is processed, Then the vendor receives a notification back that his application has been successfully processed and the products have been placed successfully.

Settings for vendors

The marketplace offers vendors free placement, entrance with any number of products, and provides assistance in their promotion. Thanks to the accumulated experience and built relationships, vendors definitely fall into our client’s target audience.

To become a vendor, it is enough to send an application and pass moderation by the marketplace administrator.

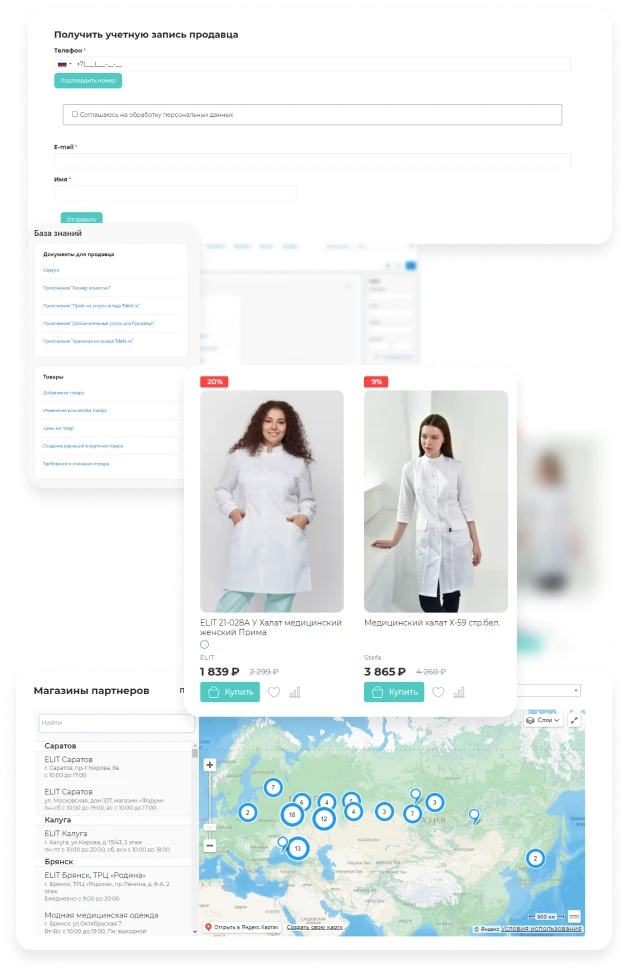

The marketplace has many rules and a certain offer for vendors, according to which they are being moderated. For this purpose we have developed the “Vendor Documents” add-on, which simplifies all the processes for administrators.

We have created a Knowledge Base for vendors,

which contains instructions, tips, for example: how to work with orders, manage products, add products, change prices. They can be created manually for different sections of the site.

Order status chain notification.

The marketplace has its own rules for processing orders, and if the vendor does not process orders for a long time, then the marketplace administrator receives a notification by mail.

Promotions.

The marketplace has their own list of discounts in which vendors may participate in. In order to do it the vendor needs to choose the size of the product discount from the proposed by the Administrator range.

Partner stores are presented interactively on the map.

It is possible to search by cities and by vendors.

Vendors can become authors on the marketplace blog for free and promote their products.

Read more about this in marketing tools.

Customers functionality

Registration

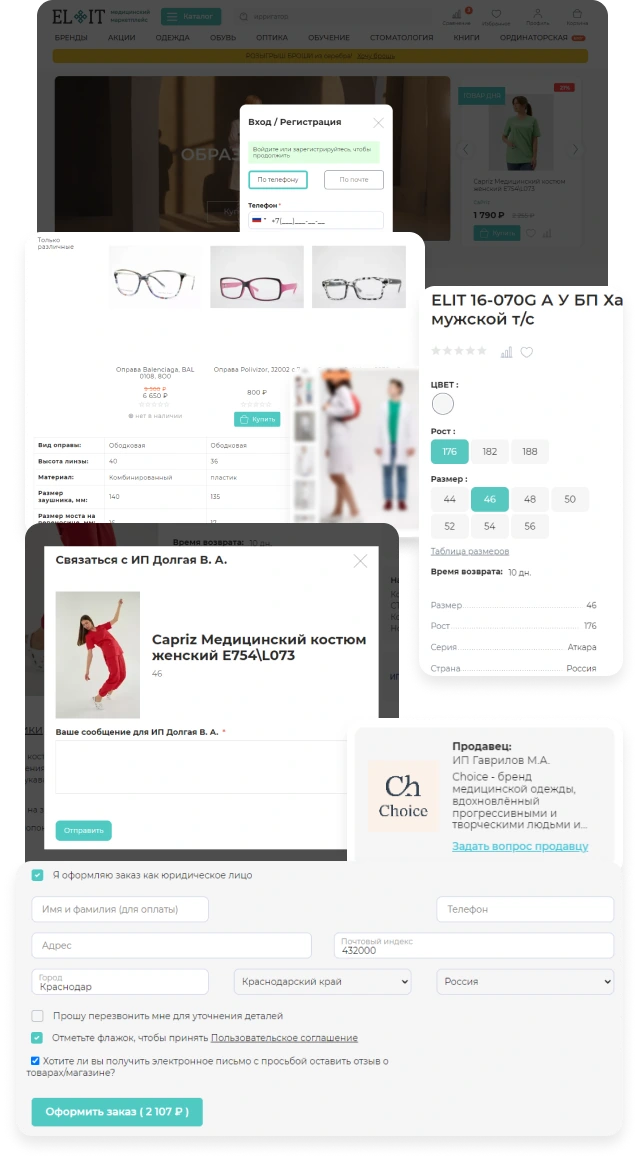

The user can register on the site in 2 steps thanks to our “Registration by phone number with OTP” add-on. Buyers do not waste time filling out long forms and go straight to shopping.

Product page

The product page with a preview is filled with high-quality photos that can be enlarged. The buyer has the opportunity to compare, add the products he likes to his wishlist.

Some products combine features, such as grouping by height and size. On some of them, you can choose height and size separately.

Communication channels

Visitors can get advice directly from the vendors or ask the marketplace employees. For a quick way to contact the customer service department and clarify questions, you can use the integrated JivoChat and Telegram bot.

Filters

Since the assortment is large, the marketplace offers wide flexible filter settings and sorting products in different categories.

Checkout

A simple checkout form involves choosing a delivery method, payment, and the ability to place an order as a legal entity. Elit accepts requests for custom orders, such as uniform tailoring for a medical clinic.

The documents

A separate return policy page, with the ability to download an application, makes shopping safe, written instructions expedite the return process and increase brand confidence.

Marketing Tools

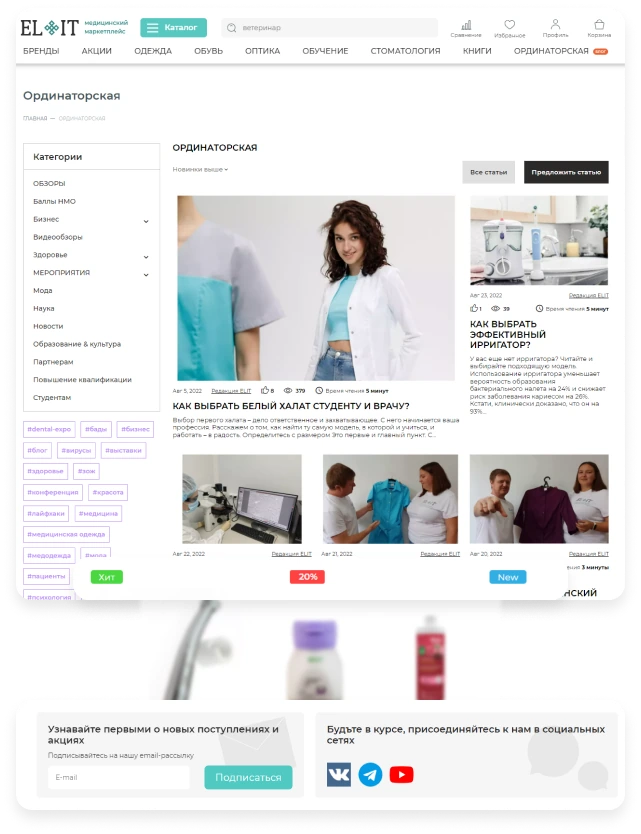

Special themed blog

Marketplace employees regularly communicate with manufacturers, conduct comparative analyzes and share expert opinions through a blog that bears the authentic name “Ordinatorskaya” which means “Medical staff room”. It talks about technologies, benefits, and gives independent recommendations. Vendors, manufacturers and sellers can post their articles and materials on the marketplace blog for free. The administrator will help with choosing a topic, writing an article and publishing the material.

In addition, the blog publishes announcements of medical events, exhibitions, and conferences.

Thus, vendors get a powerful content marketing tool for free to promote their brand, which generates organic traffic, increases the trust and loyalty of visitors.

Product labels

Thanks to the “Product labels” add-on in the catalog, you can highlight and draw the attention of buyers to the popular, new or promotional products. Color, size and image of the label can be customized by the customer for the desired purpose.

Subscribe and share on social networks

Subscribing to news, promotions and discounts works with warm users and opens up a new email marketing advertising channel. It will help convince visitors, remind you of abandoned carts and turn a loyal audience into regular customers.

Sharing buttons in social networks allow you to expand your audience reach, raise brand awareness or tell about important promotions and contests.

Our work results

The combined efforts have resulted in a unique marketplace for doctors and clinics, which attracts more than 50,000 monthly users. It presents 10,000+ products and employs 100+ partners.

The marketplace plans to expand its partner network and sales geography.

Create your fast scaling marketplace easily. Integrate with CRM, Ebay, or Amazon. Sell anything on the website, on social media or in person.

Add new capacities to your business. Extend functionality for current needs and fix old bugs.

Migrate your store to CS-Cart if your current CMS is not enough.

We will find solutions for everyone

Share your idea and we’ll offer an optimal solution